Uninsured or Under Insured Motorist in North Carolina

- UM – Uninsured Motorist

- UIM – Under Insured Motorist

Operating a vehicle in North Carolina carries with it certain responsibilities.

Pretty much everyone understands you have to have a valid Driver's License. Of course the car (or vehicle) needs to be registered, display a visible license plate, otherwise safe to drive, and properly inspected.

Unlike some other states, North Carolina also carries with it the legal responsibility to carry Motor Vehicle Insurance.

That duty is referred to as "Financial Responsibility." The General Assembly has set forth what the minimum terms of coverage are and what they cover.

Lawyers and policies refer to things such as "Liability" and "Comprehensive" coverage.

At minimum the Insured and/or Vehicle must have some sort of Liability Coverage for:

- $30,000 – Bodily Injury, 1 Person

- $60,000 – Bodily Injury, 2+ People

- $25,000 – Damage to Property

North Carolina law N.C.G.S. 20-279.21 requires insurance coverage for Underinsured Uninsured Motorists.

There are minimum Property Damage and Bodily Damage policy limits.

That is true for all insurance policies, even when the terms may exceed the minimum requirements.

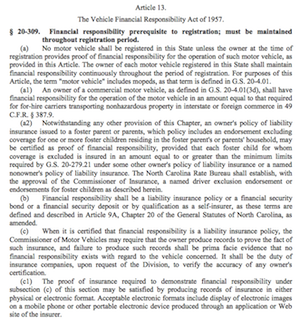

CLICK HERE: North Carolina Vehicle Responsibility Act

CLICK HERE: North Carolina Vehicle Responsibility Act MORE INFO: Motor Vehicle Policy North Carolina 2017

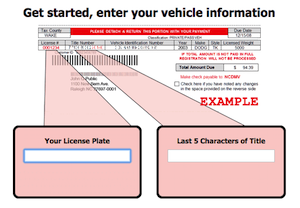

MORE INFO: Motor Vehicle Policy North Carolina 2017 CLICK HERE TO DOWNLOAD SAMPLE PLATE REGISTRATION FORM

CLICK HERE TO DOWNLOAD SAMPLE PLATE REGISTRATION FORMWhile it seems a pretty minor offense, the long-term consequences for failure to comply can be surprising complex, if not harsh at time.

Of course, if you have ever been hit with someone without insurance, it is not hard to imagine why the Legislature, Prosecutors, and the Courts take great efforts to ensure people carry insurance...and punish people whom don't.

The worst-case-scenario is when a serious wreck takes place, where there is both property damage and personal injuries.

It's one thing to get caught driving without insurance, with nothing more. If someone got hurt, or even killed in wreck where there is not insurance coverage, THAT is a sticky legal problem.

Unfortunately, generally speaking, no one plans to get in a wreck. No one anticipates serious injuries or fatalities. There is a reason why we call them "accidents."

Motor Vehicle Policies normally cover individuals whom lawyers refer to as the "named insured" and their vehicle(s).

It also provides protection in instances when "any other person" with permission to use the vehicle against "lost from the liability imposed by law for damages..."

Permission is a relative term, as the North Carolina General Assembly in writing the law used inclusive language, where that "permission" may be either express or implied.

As such, an overarching principle would appear to be to grant coverage in the event of a wreck, as opposed to allowing Insurance Carriers to deny a claim unless there was some sort of express statement to the effect, "I give you permission to drive my car."

One exception we see in the courts is where a vehicle is reported as stolen.

That may be in addition to other forms of Insurance Coverage. Put simply, it tends to be a somewhat complicated area of law.

Financial ResponsibilityShall insure the person named therein and any other person, as insured, using any such motor vehicle or motor vehicles with the express or implied permission of such named insured, or any other persons in lawful possession, against loss from the liability imposed by law for damages arising out of the ownership, maintenance or use of such motor vehicle or motor vehicles within the United States of America or the Dominion of Canada

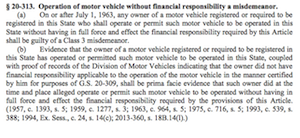

As stated in the title of the General Statute, driving around without insurance is a Misdemeanor in North Carolina.

While it is possible, if more likely than not, to be issued an Uniform Citation for a violation of N.C.G.S. 20-313, it is a misdemeanor and therefore an offense for which you can be arrested.

"Operating a Motor Vehicle" without "Financial Responsibility" cases, or what Lawyers often refer to as "No Insurance," may be associated with other criminal charges involving a wreck or reckless driving.

Once again, the General Assembly, as a matter of public policy, seeks to make certain there is coverage. As such, the Financial Responsibility Law in North Carolina applies to Mopeds too!

As of July 1, 2016, North Carolina law requires that all registered mopeds have liability insurance coverage with limits no less than $30,000/$60,000/$25,000. Failure to maintain liability insurance coverage constitutes a lapse and may result in the revocation of your valid North Carolina license plate

CLICK HERE FOR QUIZ: How Much Do You Know About Traffic Tickets in North Carolina

CLICK HERE FOR QUIZ: How Much Do You Know About Traffic Tickets in North Carolina CLICK HERE: Misdemeanor Sentencing in North Carolina

CLICK HERE: Misdemeanor Sentencing in North CarolinaNothing prevents or precludes law enforcement officers for charging motorists with several different offenses, all at the same time.

And while a Class 3 Misdemeanor is the lowest level of criminal offense in North Carolina, it still in certain circumstances carry an active term of incarceration (normally that would require a pretty extensive prior record).

Failing to maintain Financial Responsibility can also be the basis for a Revocation of your Operator's License in North Carolina and Cancelation of Vehicle Registration.

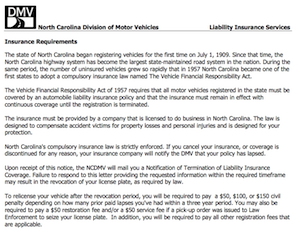

If liability insurance coverage lapses for any reason, the insurance company is required to notify NCDMV

The Department of Transportation / Division of Motor Vehicles DMV thereafter sends what is known as a Liability Insurance Termination Notice (Form FS 5-7).

You only have 10 days to respond to the Notice. That 10 days is from the date printed on the Form FS 5-7, not necessarily when you receive it.

Civil penalties assessed for a lapse in liability insurance are based on the number of prior lapses a registered owner has had on his or her vehicle within three years of the current lapse:

- $50 – first lapse

- $100 – second lapse

- $150 – subsequent lapses

It can also hit you in your wallet, as a violation of the law carries with it 3 Insurance Points.

MORE INFO: How Violations Affect Insurance Rates

Modified Transcript of "Uninsured Underinsured Motorist Traffic Law Issues in North Carolina" for the Hearing Impaired

Hey, this is Bill Powers. We thought we'd throw up a page on our website regarding uninsured and under-insured motorists. Lawyers often refer to this as "UM, UIM" uninsured, under-insured. I wish they'd change that, to tell you the truth. I wish they'd call it A and B, and Z-Y. So you don't get confused. It tends to apply more to civil law, and in the wreck, and whether you've got enough insurance or any insurance at all. But there are consequences of that in criminal court as well, in wreck cases. So I'm gonna focus this page on wreck cases and the crossing over of civil issues with criminal issues.

So there's a wreck case, you have no insurance, and someone's hurt. So there's another vehicle involved. I'm just trying to think of fact scenarios where we see these things. Is that a civil violation, or is that a criminal violation? The answer is, it could be both. Civilly, when I say a violation, you're supposed to be carrying insurance. If you don't have insurance, you may have personal liability if it's through an employer. The employer may be responsible, and so there's this determination of "Is there insurance coverage? Is there [inaudible 01:49:11] policy?"

Criminally, no insurance is an offense that you can be prosecuted for. You can get Motor Vehicle Points and Insurance Points, and if they get a judgment against you, and that judgment is not paid, they can actually end up suspending or revoking your license until you take care of it.

Under-insurance, well, not really. We have some minimums set by statute. In North Carolina, it's not criminal to have the cheapest form of insurance. I don't recommend it. I'd tell you to get insured as much as you can, unless you just don't care about your house, your car, your property, or your future. I don't sell insurance, for the record, but I think it's better to have good insurance than not enough, and that's just from seeing lots of tragedies over the years. It's also helpful that if you have- [inaudible 01:50:03] tragedies over the years. It's, also, helpful that if you have something more serious where someone dies, not intentionally, but at least you can offer some level of compensation financially through that policy, hoping to make that family right. I've represented a good number of these fatality cases, DWI cases, murders, manslaughters, and I can't think of a single one where my client didn't just feel awful for that other person. It may be cold comfort, it may be a small part of that case, but just knowing they had good insurance, and that there would be some recourse for that family, in my mind, is invaluable.

If you have questions about insurance, insurance coverage issues when it applies to criminal court, or accidents, or DMV, or license restoration issues, we're here to help you. If you have a question about UIM coverage and a subrogation lien involving multiple carriers in a multiple state claim, we're probably going to refer you to someone that we know in the state who handles that type of area of law.

Our consultation is free. We're not a referral service. If we know someone that may help you out, we'll give you a name and number. We don't charge to do that, and it's confidential. We don't charge to talk to you, and maybe get you pointed in the right direction. That's part of being a lawyer. Part of helping people and servicing the community is being available to answer questions, even when we can't provide legal advice. Sometimes just answers and information is the most valuable thing we have, and we enjoy doing it. Give us a call, 704-342-4357. Talk to you soon.

Helpful Information About Criminal Charges Powers Law Firm PA Home

Powers Law Firm PA Home